We all have witnessed the emergence of the Indian e-commerce sector in the last decade begetting unicorns such as Flipkart, Myntra, Snapdeal, Jabong, Udaan etc. As more and more shopping happening online, apart from product images video has an important role in helping viewers discover new products and find expert advice they trust.

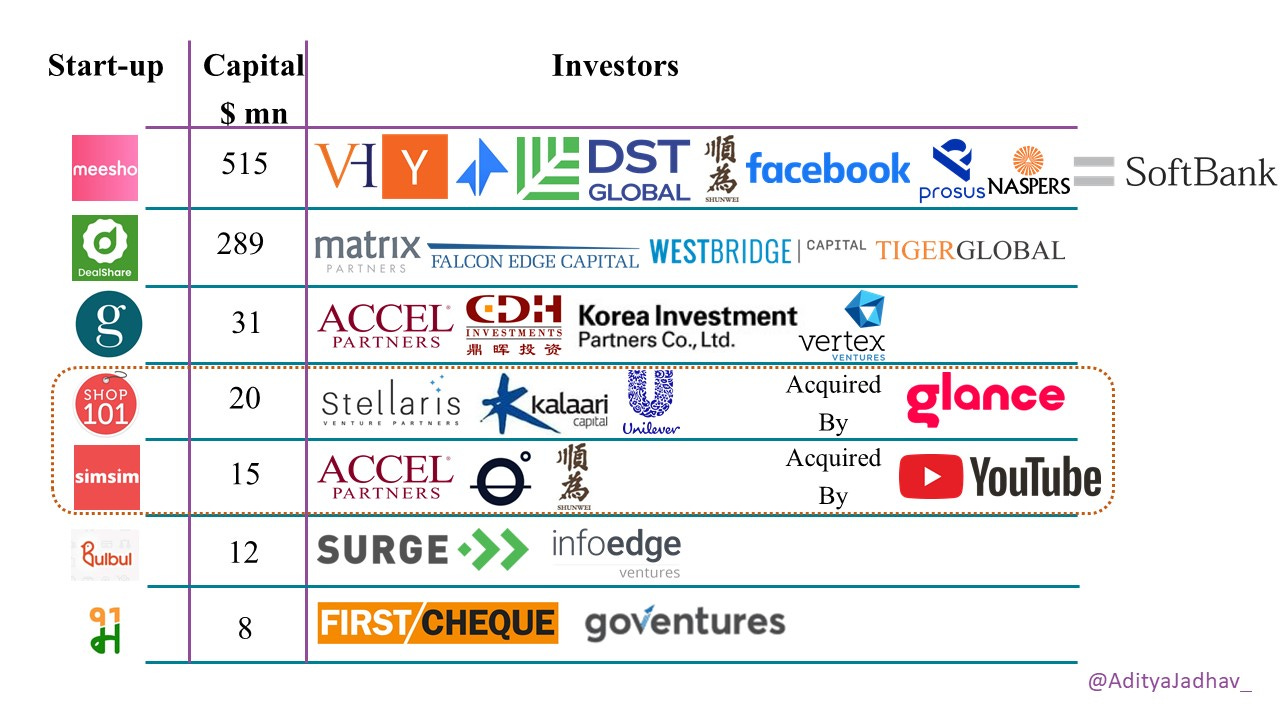

Acquisition of SimSim by YouTube, Shop 101 by Google funded Glance and the $300 mn funding round of Meesho led by Softbank has put Social Commerce in limelight.

Although Meesho has already achieved the status of Unicorn, a couple of next unicorn / decacorn will emerge out of the Social Commerce sector.

Lower price internet and penetration of FB, WhatsApp driving Social Commerce in Tier 2+ town

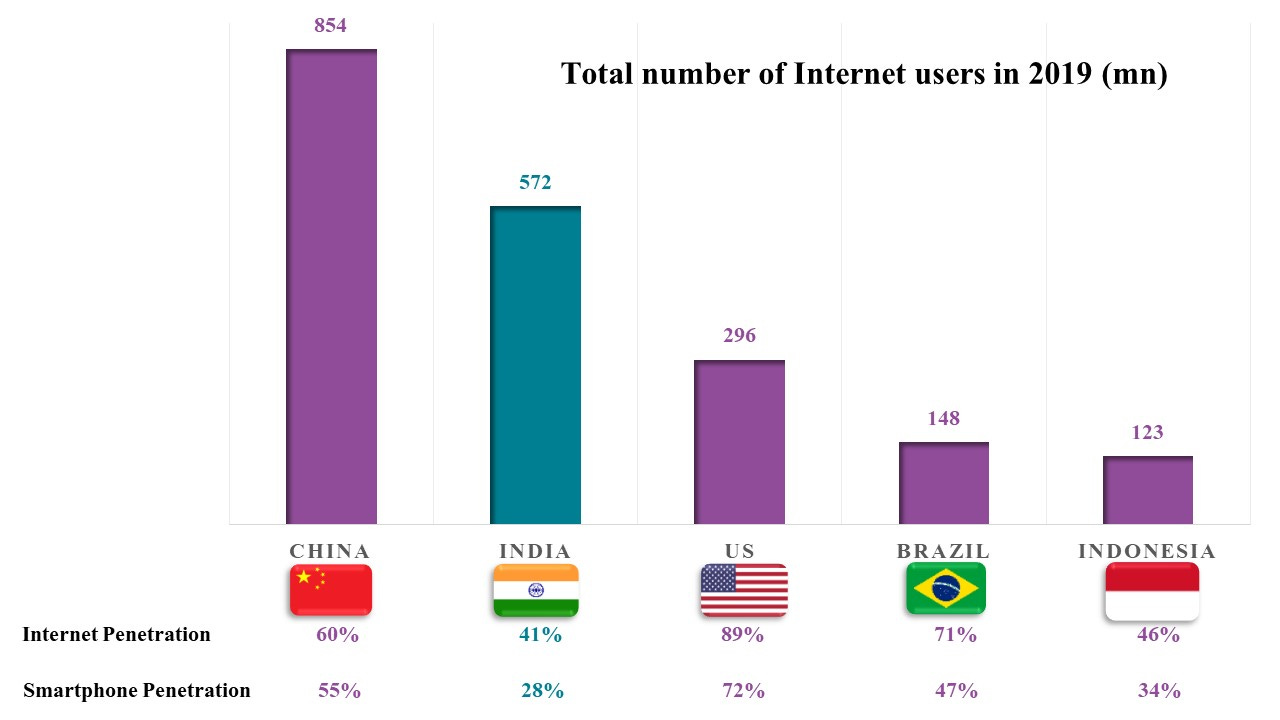

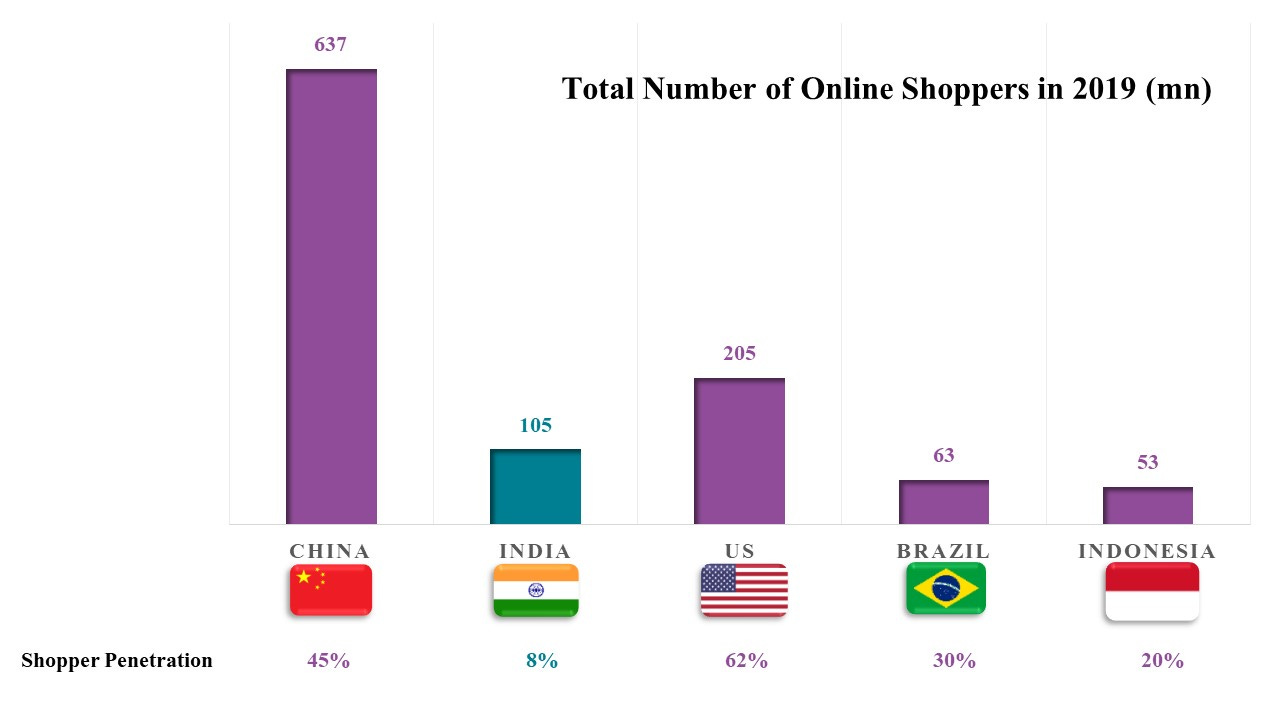

Powered by cheap data (thanks to Jio), supply chain innovations and digitally savvy customers, e-commerce has become a $30 bn (GMV) industry in India in the fiscal year 2020. With just 41% penetration, India still ranks the second-highest number of connected users globally, at around 572 mn, with substantial room for growth. However, only 8% (~105 mn) of Indians shop online and lack of trust is the biggest inhibitor for their online shopping.

Over the last couple of years, the number of online shoppers from Tier 2+ towns have surpassed the number of online shoppers from Metro and Tier 1 towns together.

Tier 2+ shoppers account for 53% of the total userbase now and have grown at a CAGR of 35% during the 2016-20 period. This growth was led by factors such as reverse migration, users adopting digitization, more awareness among others etc.

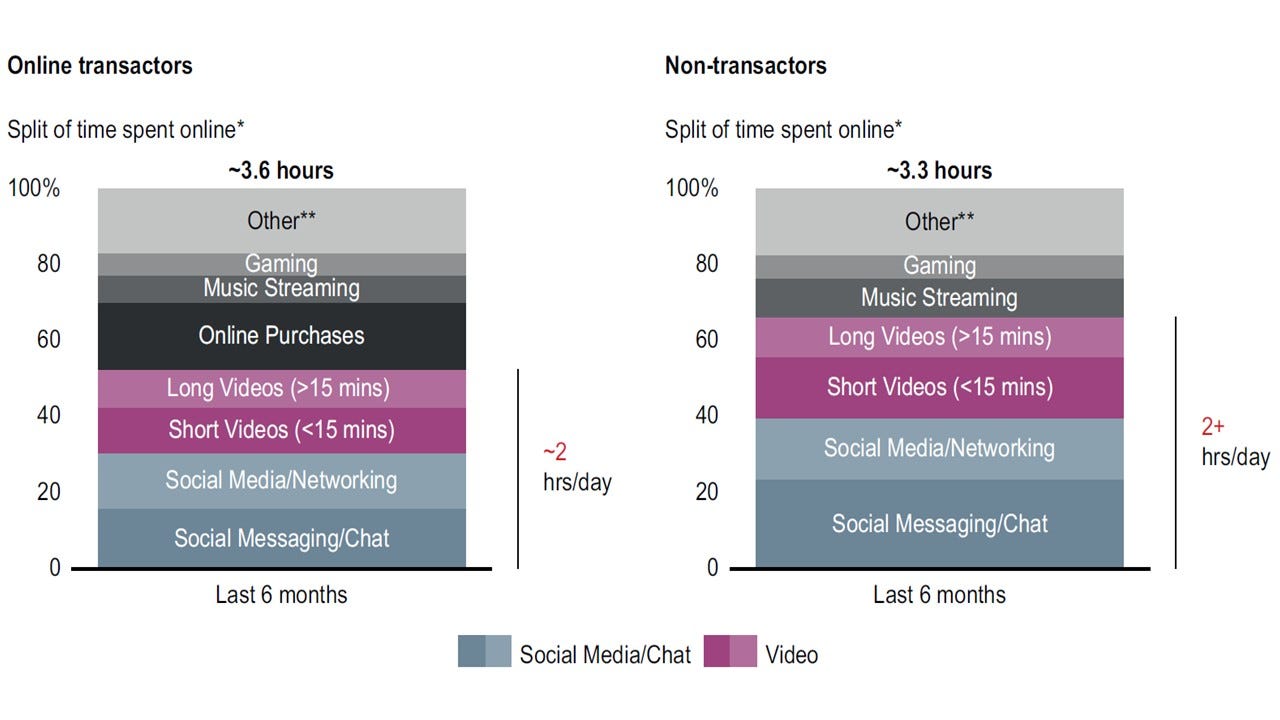

Social and video platforms have more universal usage, as internet-connected Indians spend an average of three hours per day online, of which more than two hours are consumed in messaging, social media networking and watching videos.

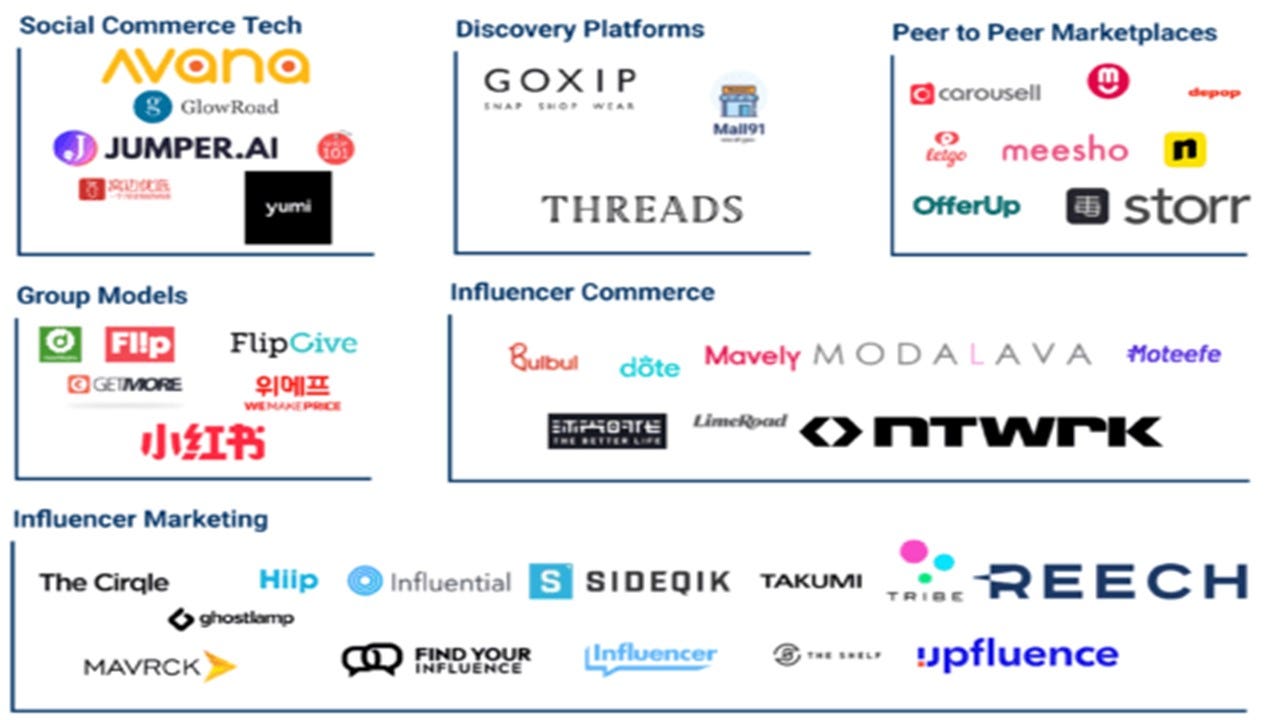

Evolving business models in Social Commerce

Social commerce is a segment of e-commerce that involves social media and online media and supports social interaction, and user contributions to assist online buying and selling of products and services. Social commerce is a $1.5 - $2 bn GMV market today, will be worth $16 - $20 bn just five years—and will likely hit $60 - $70 bn by 2030.

India’s Social Commerce sector will be two times the size of the current e-commerce market within ten years.

The Social Commerce sector is still evolving but there are 5 platform models which are emerging out of it.

Video / Live Commerce

The Chinese retail giant Taobao had pioneered a powerful new approach: linking up an online live stream broadcast with an e-commerce store to allow viewers to watch and shop at the same time. Live commerce is entertaining, immersive, and viewers keep watching it longer. Time-limited tactics such as one-off coupons can be used to generate a sense of urgency.

Companies report conversion rates approaching 30% - up to ten times higher than in conventional e-commerce.

McKinsey research indicates that live-commerce-initiated sales could account for as much as 10 to 20% of total e-commerce by 2026. Indian start-ups which fall under this category are BulBul, SimSim etc.

Social Reselling (P2P)

The platform model earns sales through resellers - first-time entrepreneurs who resell these products to their networks, thereby easing retail customer acquisition for the platform. In India, more than 75% of these resellers are women, mostly homemakers or self-employed / business owners, who earn ₹5,000–10,000/ month through reselling, thereby supplementing their household income.

More than 80% of sales are generated by selling it to a network of close friends and family/relatives, primarily through WhatsApp.

Fashion is the most dominant category, followed by Beauty & Personal Care and Home Décor. Indian startup Meesho is the most widely used platform, followed by GlowRoad and Shop101 in this category.

Group Buying

The platform enables consumers creation of social communities/interest groups to build trust and to purchase in bulk for lowered prices. This model was initiated by Pinduoduo which had extensively leveraged the WeChat platform with more than a billion users and payment technology for its own growth.

The platform is more focused on value for money shoppers, who use it to purchase regular household purchases and seek discounts.

Vernacular group-buying social commerce platform Dealshare is an example of this model. Dealshare leverages a network of Kirana stores to serve as logistics spokes to reduce last-mile delivery costs and service low order values. The majority of its customers are new-to-internet users who live in Tier 2+ towns and smaller towns.

Social Network led

In this model, the Consumer discovers products/services on social media platforms such as Facebook, Instagram and interact with sellers on these platforms before making a purchase. Almost half of the social commerce consumers use Facebook, Instagram as a discovery tool, as they do not know what they are looking for and are not loyal to specific brands. Nudges or recommendations from relatives and friends are a big driver of action, and impulse purchases present an opportunity for sellers.

Chat / Conversations led

Food & grocery Kirana stores are using chat platforms such as WhatsApp for aggregation of grocery orders as it is extremely convenient for customers to message the list of products through Whatsapp and make payments.

Social Commerce startups are tapping new value-conscious consumers from Tier 2+ towns, which are not getting served by horizontal e-commerce platforms such as Amazon, Flipkart due to higher CAC and higher logistic costs. Resellers help these social commerce platforms in acquiring customers at much lower CAC. In sharp contrast to the larger, organised seller base on Amazon, Flipkart etc., 85% of sellers using social commerce are small, offline-oriented retailers who have found that social platforms enable them to connect with buyers who might not otherwise have discovered their store.

Thus, social commerce has the ability to empower more than 40 mn small entrepreneurs across India.

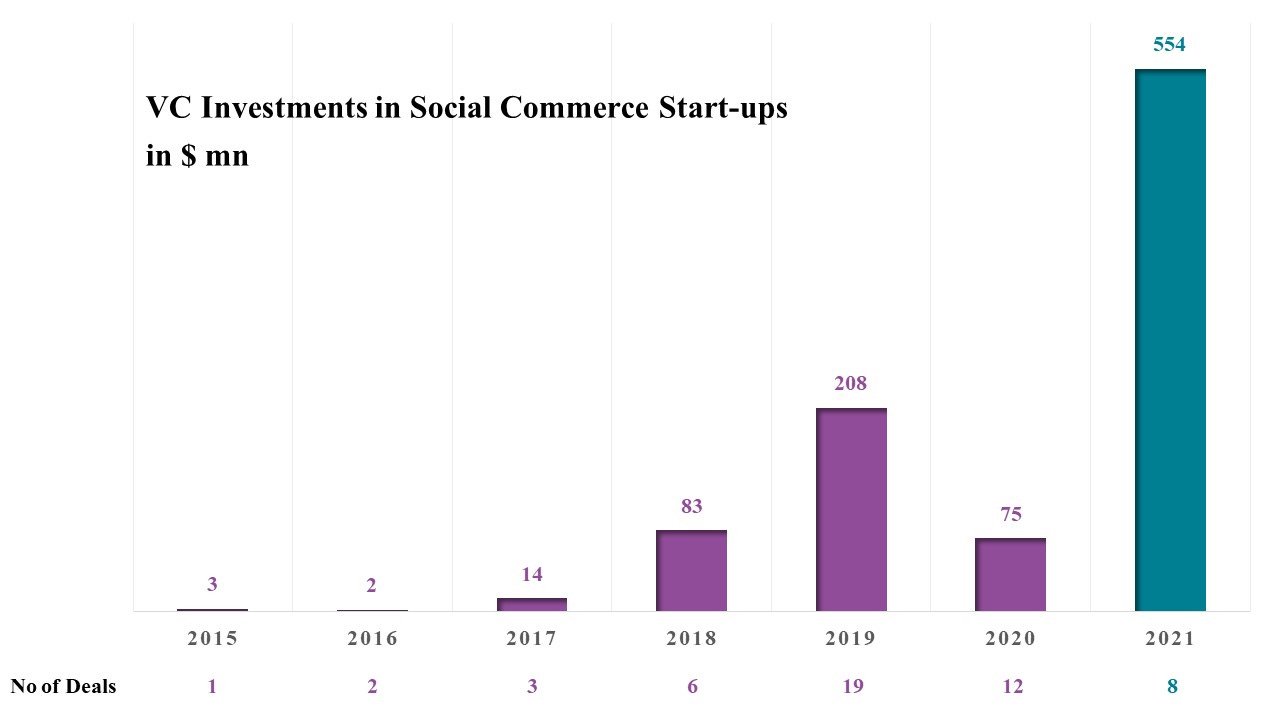

Social commerce startups have raised more than $550 mn in 2021, a 7x jump from the last year and the amount reached an all-time high according to Venture Intelligence. Social commerce is $1.5-2 bn sector in 2020, out of which reseller platforms are still at a nascent stage with a size of $400 mn and video commerce, group buying market opportunity at $100 mn.

Social commerce is likely to grow at a CAGR of 60% to become a $16-20 bn sector by 2025 and will become a $60-70 bn sector by 2030.

Considering that market opportunity is likely to grow by ~40x in the next decade, VC funds such as Accel, Sequoia, Shunwei are betting on multiple platform models and we should expect a couple of next unicorn / decacorn will emerge out of the Social Commerce sector.

Vert well written and interesting!